I have moved my blog here.

Hope to see you there :)

I have moved my blog here.

Hope to see you there :)

My name is Adrian and I’m addicted to Kickstarter.

My desk (pictured) is literally littered with the residue of my impulsive habit.

I’m particularly addicted to ordering headphones and earphones and typically have three generations of those on order at any one time.

But, I’m lucky. I can easily afford my habit; even my wife doesn’t seem to mind.

She’s used to me buying cars (my Tesla is STILL on order) and even our house (lucky I didn’t click “add 2 to cart”!) online and sight unseen.

But, I’ve recently picked up a dangerous new habit; one that I am keen to nip in the bud:

A few weeks ago I was browsing a US-based equity crowdfunding site (one that I happen to own a small sliver of, through an acquisition of one of my early investments) and, soon found myself clicking a button to invest $10k in a …

[drum roll]

… battery operating system.

What the #@$% is a ‘battery operating system’?

I have absolutely no idea, yet I am the proud owner of (part of) one!

So, here is the first of three reasons why I am philosophically against equity crowd funding sites (like: Venture Crowd, Our Crowd, and Fundable):

The size of the bet is much, much larger than product crowd funding sites (like Kickstarter, Pozible, and Indiegogo).

Bigger bets mean bigger wins (potential huge ROI in one v. a piece of soon-redundant plastic-encased electronics in the other). But, it also means bigger losses (it’s annoying when your $99 Kickstart project doesn’t deliver, but hardly damaging to your retirement prospects).

This is why I call it #dumb #funding … equity crowd funding is akin to gambling, and I expect to see lots of people in sequinned suits and dark sunglasses pulling slots.

But, after a lot of reflection, I’ve realised that I only have two issues with equity crowd funding … and, I believe that both of these issues are curable, at the equity crowd funding platform level.

This means that governments don’t need to deal with my issues (well, I am still philosophically against the mug punter making $10k - even $1k - bets); the platform owners themselves can … if they are so inclined.

Issue 1 - How to create diversity in your startup portfolio?

Over time, a popular equity crowd funding site will have a plethora of startups for even the uninitiated to invest in (which is the purpose of the proposed new laws).

But, at any one time, they may have only a few listings …

The danger is that people will only get excited about one or two startups, from the limited selection available, and invest too heavily in those.

When it comes to investing in startups, however, more is better:

David S Rose (regarded by many as the father of angel investing in NYC) says:

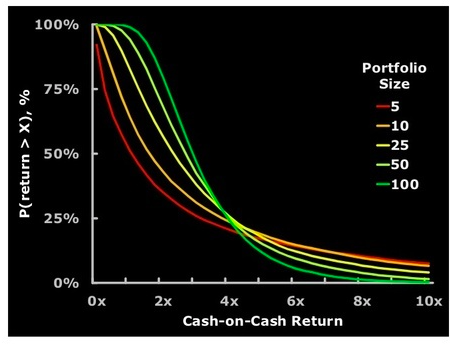

Going from a portfolio of 5 to a portfolio of 25 doubles your chances of making 2x on your investment.

If you invest in fewer companies you’ll have a less than 50% chance of even getting your money back, let alone getting any return.

The science is clear: to make a profit investing in startups, you must divvy up whatever total amount you have to invest (over, say, a 3 to 5 year period) into 10 to 20 roughly equal ‘units’ and commit to investing one unit in each of 10 to 20 startups over that set period of time.

In theory, equity crowd funding sites make it easier to invest in more startups (e.g. many will take investments as low as $1k) but, in practice, there’s no mechanism (and, by mechanism I mean something more than a disclaimer or a note on a web page) to ensure that occurs.

Issue 2 - Does diversity equate to success?

With many - most - equity crowdfunding sites, it is in the operators’ interests to curate the investments that come on board … but, one could be cynical (hey, that’s my middle name) and point to their compensation:

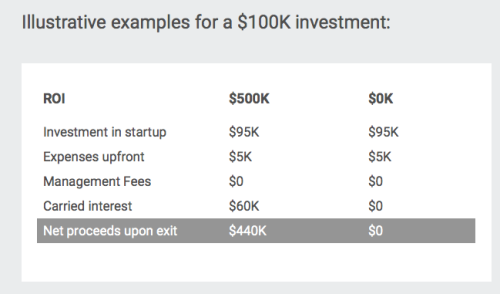

It comes from ‘fees and charges’ (on listing and/or successful fund-raising), as well as participation on the upside.

A true investor only makes money when the founders make money (participation preferences and liquidation preferences aside).

One could argue that VC’s have a similar model: carry (fees charged to investors) + profit share (on the upside).

The problem is that VC’s have limited bandwidth: they can only take as many startups as they have capability to take board seats. This is one of the reasons why VC’s limit their number of investments. For a VC, curation takes on a special meaning.

But, is it important in angel investing (or equity crowd funding)?

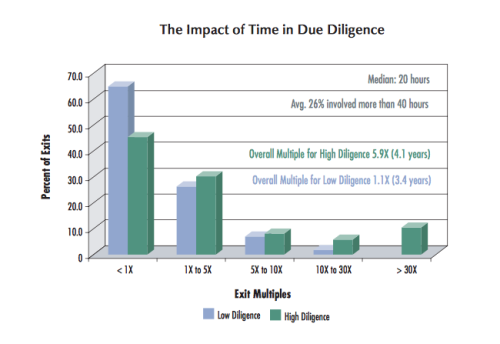

In their 2007 study (”our findings in this study are based on the largest data set of accredited angel investors collected to date”), the Kauffman Foundation found:

Spending time on due diligence is significantly related to better outcomes. Investors who spent more shows an overall multiple difference of 5.9X for those with high due diligence compared to only 1.1X for those with low due diligence.

Even for AngelCube, the Melbourne-based accelerator that I cofounded in 2011, curation & Due Diligence is critical: 100+ applicants are whittled down to around 7 participants in each annual ‘batch’, through an intensive selection process.

[If you think about it, we (AngelCube) select 20+ to interview, using a crowd funding platform: Angel List. It’s exactly the same as clicking to invest yet, through our follow-on F2F Due Diligence process, we then discard at least 2/3 of those that looked good ‘on paper’. Food for thought?]

Not so for equity crowd funders: they can (in theory) have as many startups listed as they like. More startups (&/or more startups that raise) = more fees.

Fees v. platform reputation … at best, an interesting trade-off?

So, curation is important …

What about advice?

To be fair, there’s a debate as to whether advice during the customer-discovery and growth phases is a factor in startup success, but - again, according to the Kauffman Foundation - that argument is a non-starter:

Expertise had a material impact on angel investors’ earned returns. Investment multiples were twice as high for investments in ventures connected to investors’ industry expertise.

Clearly, it’s not enough to simply invest in one or even a bunch of startups: you also have to know what you are doing …

OR,

… you have to follow somebody who does.

If I’m going to invest in a startup that somebody recommends, it’s going to be because I trust their judgement and they have put their own money up first.

The Cure

Fortunately, I believe there’s a model for equity crowd funding that can work, and I have even found an example …

Israel’s iAngels (I am not associated in any way) is a crowd funding site that appears to operate almost 100% accordingly to the playbook that I would have written:

For a startup to be listed on their site, an accredited angel investor must have already invested their own money.

THEN iAngels decides if they want the startup listed on their platform … in other words, the equity crowd funding site’s own due diligence is secondary.

Primary due diligence, as it is in the ‘real world’, is made by the gal who is putting her own money in first.

Moreover, and I believe this to be critical (in fact, iAngels added this FAQ, after I queried them on this specific point):

All investors who join the round through iAngels, come in under the same exact terms that have already been decided upon by the lead angels.

If the investor puts in a significant % of the total money to be raised first (iAngels assures me that it’s usually 40% to 60% of the round, but never less than ~25%; this is important for the startup raising, too, to ensure that they have a good chunk of ‘smart money’ invested in each round)

AND,

If the mug punter gets exactly the same terms as the investor has negotiated for themselves,

THEN

Go ahead, knock yourself out, invest in some startups!

Is this a total cure?

No. Because there is nothing to stop an investor from investing in just one startup, rather than David S Rose’s recommended 10 or 20 … e.g. on iAngels, there is only a note on a page that many people probably won’t even bother reading:

We recommend maintaining a well-diversified pool of assets – both across multiple startups as well as other non-correlated asset classes. If you are not a professional venture capital investor, it is not recommended to invest more than 3% of your financial assets in early stage companies. If you decide to invest in early stage companies, you should target a portfolio of at least 15 investments.

Startup investing is not liquid and takes longer to realize returns. According to research from 2012, it takes an average of 5-7years for a startup in a venture capital fund’s portfolio to reach a liquidity event (either an IPO or an acquisition).

A better idea, would be a fund attached to an equity crowd funding site: pour whatever money you have in the top, and the site asks you to Choose 5. Rinse and Repeat each year for the next 3 to 5 years.

So, equity crowd funding can work if people:

1. Only invest their $ where people who should know better have already invested far more of their personal $$$ (on exactly the same terms), and

2. Commit themselves (e.g. via a fund) to making 10 or 20 similarly-sized such investments over, say, 3 to 5 years.

But, how do you ‘make’ people invest (gamble?) only the 1% to 5% of their meagre life savings that good financial sense would allow? And, how do ‘make’ them diversify?

I don’t think you can … just like you can’t ‘make’ people stop gambling their life savings away on the pokies.

Whilst that’s an issue for governments and community support groups to contemplate, the concerned citizen in me still can’t help wondering:

How does adding yet another avenue for speculation improve that situation?

###

* Crown Funding?

Earlier this year, I wrote about my plan to donate $10k to Startup Vic if just one female-led team made it into AngelCube’s 2014 cohort.

That happened and the grant was made, and I’ll wait - along with everybody else - to see what comes of it. I know that plans are already afoot (but, I’ll leave it to Startup Vic to make their own announcements when ready).

I outlined my reasons for the grant in this post: http://ow.ly/ANECA

But, it was mainly for two reasons:

1. Out of the 19 startups that we (AngelCube) accelerated through to the end of 2013, only two female founders participated.

2. Founders Institute trumpeted their Female Founders Fellowships (http://www.fi.co/contents/fff) which amounted to little more than some discounts on their fees and a small $1k prize.

So, I went on a bit of a Twitter rampage and tried to stir up some mud, with mixed results …

Fast forward to 2014 and AngelCube had three teams with female-led founders, including one all-female team. Sadly, I can’t take credit; it was just the universe karmically rebalancing.

Brandspot, as Kate and Amanda’s amazing startup is called, won my personal $1k grant, which was in addition to the $10k that Startup Vic also received, but either of the other two female-founder-led teams could easily have taken the prize.

All of which goes to highlight a point that I have been making all along …

Startups should be an equal opportunity sport.

For me, I would never like to see an end-game where there is either affirmative action or negative action - both of which, to me, are just forms of discrimination - when it comes to launching, funding, and scaling Australian startups.

Alas, AngelCube’s current cohort aside, the current gender-unbalanced shape of the Australian (probably the world’s) startup ecosystem doesn’t yet support my dream; hence the grants.

Whilst I failed to get Founders Institute or Scale or any of the others that I hassled to match my donation (yet!), FI did manage to bring me on board as an occasional mentor … I guess Matt Allen’s simply a better negotiator than me.

I’ll do another update when Startup Vic announces their ‘more female founders’ strategy … stay tuned!

I’m making a conscious decision to invest in fewer startups. Well, at least thinking about it. Am I worried about a tech bubble? Nope.

It’s far more fundamental than that …

To understand what’s going on, I need to share a story about my first angel investment.

I didn’t have a history of investing in anything other than real-estate (and, my own business) until I sold my business.

In fact, selling my business was the first M&A transaction that I was ever exposed to - until then, I lead a sheltered existence as a lone entrepreneur, I guess.

Actually, selling was the second M&A transaction, the first one that I was heavily involved in was a joint venture agreement in New Zealand, quickly followed by a much bigger one in the USA.

But, a few years later I sold my businesses to a UK listed company in a series of 4 transactions (two London stock exchange announcements during 2006, each with a separate earn-out agreement: 4 in total).

I then learned a lot about mergers & acquisitions, as I stayed on for a while to head up a key US division of my acquiring company as we embarked on a short-lived spending spree: I left the USA in 2008, amid the financial crisis which put a lid on M&A activity for us, and just about everybody else on the planet.

It was around then that, cashed up, I made my very first angel investment.

The founder was a serial entrepreneur with one exit already under his belt; the other founders were PhD’s at one of the best colleges in the country with a hot new (& patented) network performance monitoring technology in their hands; and, the market was every Fortune 1000 enterprise with a network i.e. ALL of them.

On the surface, it sounds like a well planned and executed investment: right people; right product; right market.

And the result was a 20x cash return after just 5 years (with upside still to come). What a way to start an angel investing career!

Still, the reality is far more banal: one of my close friends told me that he was getting back into the game and asked if I would like to invest in his first round.

Since he was a close friend, I said (virtually sight unseen): “sure”.

I didn’t read the docs, didn’t even know what a convertible note was, and I didn’t really understand the company or its technology.

But, he was - and is - a close friend and it all worked out.

Here’s the obvious problem: I was lucky.

So, now I know a bit more about startups and investing … and, I even read some of the legal docs that are thrown in front of me.

But, I need to slow down, because I’ve realised that I’m no smarter than any other investor, and nowhere near as smart as many.

In his new book (out today), an investor who is smart, New York ‘Super Angel’ David S Rose says:

At least 75% of startups really, truly, shouldn’t be funded … by anyone, under any circumstances.

How did I know that my friend’s company wasn’t one of those?

I didn’t.

With every investment you make, no matter the criteria that you apply, there is one undeniable fact:

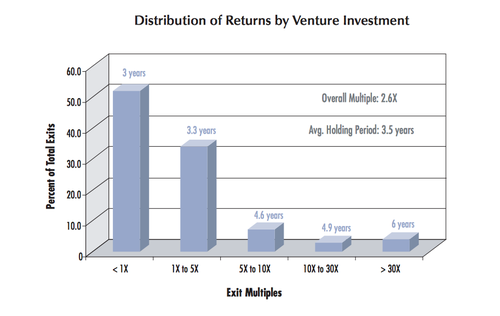

Fully half of all angel investments fail to return the angel investment made

And, most of the other half return 'just’ 1x to 5x the angel’s money invested.

So, what is the real reason why I’m slowing down after having made a 20x cash return on my first ever angel investment?

Every now and then, you can get lucky or unlucky, but - over the long haul - you can’t fight the math …

So there’s no mistake, let me start by saying that I have NO idea how to balance the apparent gender divide in the Australian startup scene!

But, I think I can do something to help those that think they do …

My inspiration comes from Founders Fund:

In 2011, we introduced the Female Founder Fellowship program, which would allow females to apply to the Founder Institute for free ($50 value), and also provide a free Course Fees to our best female applicant in each city ($1,100 value).

IMHO, it’s a token gesture, made up of $50 discounts and a single $1.1k prize to one female led startup in Melbourne each intake; with his resources, and a little well-meaning prompting, I think Adeo Ressi could do something even more meaningful.

Still, it’s a good start and got me thinking: how could I do better? More importantly, how could we - Melbourne’s startup community - do better?

The real answer is: I have no idea … but, I’m betting that someone will know.

So, I discussed this with my wife (a pioneering female ‘techie’ in her own right) and we decided to:

A. Make one grant of $1,000 for the best female led startup that makes it into the AngelCube program in 2014. This is an unashamed knock-off of the Founders Institute offer.

BTW: this will be a personal donation, in addition to the $20k that AC already offers to all successful applicant teams.

B. Make a matching $10k grant where I think it will provide the most benefit to ALL the future female tech entrepreneurs in Melbourne i.e. to Startup Victoria.

Startup Vic will need to apply this grant, if somebody wins it on their behalf, to programs aimed specifically at supporting (or increasing the number of) female tech entrepreneurs in Victoria during 2014 and/or 2015.

And, I’m hoping that the person (or people) in Melbourne who do have some ideas on how rebalance the ecosystem here will put their hands up and help Startup Vic light the way on this issue.

I’m also hoping that by leading the way (supported by our cheque), Startup Vic will be able to find corporate and vested-interest sponsors to follow with their own financial and other assistance. It’s much easier to get money if you already have a little.

But, this 'grant’ has to be won!

I strongly believe that you can only help somebody - or a group of somebodies - who first help/s themselves …

By this, I mean that female led teams (at least, startup teams that include a female in a key founder role) need to show that they are indeed willing and able to help other female tech entrepreneurs succeed by applying to AngelCube, then succeeding in being selected into our 2014 program.

If just one such team succeeds (and wins the $1k 'grant’), my wife and I will step in to help more succeed (by donating $10k to Startup Vic). It’s as simple as that!

Note: this is not an official AngelCube program; as of this writing, I haven’t even discussed it with my cofounders, but I did break character to first discuss it with my wife. Needless to say, she broke character and agreed ;)

There’s been a bit of press, Twitter, biz blog buzz (I like the aliteration!) lately about the Aussie ‘brain drain’.

I don’t want to weigh into any of that, other than saying that I don’t want to see any startup leave Australia because the infrastructure (be it legal, economic, taxation, investment, and so on) is sub-par.

I’m doing some work on all of this through my association with Investors Org and will post here when we have something worth sharing.

What I do want to address right now is: should early-stage Australian startups relocate to San Francisco (or, anywhere else) as a natural outflow of starting their business?

I had the pleasure of joining a few of Melbourne’s startup glitterazzi at a small breakfast with Paul Chen from DLA Piper’s Palo Alto office, where he told me that he advocated that Aussie startups don’t rush to the 'valley.

Paul later shared his views with Rose Powell from StartupSmart:

“You do need a centralised decision-making team in the United States, but we advocate startups or technology companies leave some of their management and IP in Australia”

But, Paul is largely talking about startups that already have seed funding and are looking for their Series-A.

It’s also important to note that what we call Series-A in Australia is really just a 'seed round’ (i.e. < $1m - $2m) in the USA … certainly Silicon Valley, where a Series-A is “$2m - $5m”, according to Paul Chen.

This is not a new debate. Almost 18 months ago, Rebekah Campbell wrote an article for StartupSmart outlining the problems that she was facing trying to balance the benefits of Posse - her startup - being based in Australia (Commercialisation Australia Grants, testing new products 'under the radar’) against the problems (relative lack of funding, small market size, distance).

Clearly, many Australian startups have conquered the world from Australia: Atlassian (now, on the move); SitePoint/99designs; and, RetailMeNot ( acquired by a US company and successfully IPO'ed over there) are the obvious examples … there are many others.

So, where do I stand?

Well, I had no trouble picking up my family of 4 (plus the dog!) and relocating to Chicago for nearly 5 years to follow my business dream, so I am relatively unsympathetic to those founders who don’t want to move.

But, one can argue that I’m a dinosaur and the Internet has removed all barriers to conquering global markets from home.

The question remains: should you move?

To help answer that, I simply ask: where are your customers?

I feel that you should always be close to your customers …

And, for most startups that I come across lately, it seems that the bulk of their hoped-for users will come from the USA.

The culture in the USA, despite all the canned TV that we receive from the studios in LA and elsewhere, is really quite different to that of Australia.

If you don’t truly understand that culture, it makes it all that much harder - obviously, not impossible - to win the hearts and minds of the users that you need.

This was all brought home to me when I first hit the ground in Chicago in 2004. I saw a sign on the side of a bus shelter that read something like:

“Take at least one week’s vacation this year; it’s healthy”

Coming from Australia, where we simply handed our staff 50 days off a year (instead of bothering with all the red tape around approving: annual leave; public holidays; sick leave; rostered days off), to the USA where one of my employees had 20 years vacation owing (!), this cultural difference came as quote a shock … the first of many (for example: most Americans have no idea who 'Bob’ is and why he’s your 'Uncle’)!

So, my question remains: if the US is your intended market, what’s stopping you from basing yourself there?

Do what Paul suggests: build your team in both the US and Australia and, once you exit, come back, have lots of babies, spend your hard-earned money in Australian shops and supermarkets, and help the next generation of entrepreneurs follow in your footsteps.

Why?

Because Australia’s the best place on earth to live, and the food in most parts of the USA is inedible.

I decided to start blogging so that aspiring Aussie entrepreneurs can learn what it really takes do a startup here in Australia.

So far, I’ve backed 19 startups through the AngelCube accelerator, and quite a few more on my own (just don’t tell my wife!), so I might have a couple of ideas worth sharing …

Here’s the e-mail that triggered it all:

“I think I have an idea for a Twitter-linked social platform that I believe would have traction within a global market across web and mobile environments, but I am unsure where to start in terms of developing an interface/website.

I was wondering whether you would have any suggestions for a direction in which I should aim, in order to present some kind of realistic application to your company? My thoughts were along the lines of a graphic representation of my idea that I could generate through a program such as Adobe Illustrator?”

What is wrong with this email?

Two things (amongst many others):

1. No validation

2. No tech cofounder

[In another post, I’ll tell you why ideas are worthless]

Here’s my reply to Thomas:

“Social ideas generally go big or go bust (more likely the latter than the former); in order to go big, you’ll eventually need to be able to convince a major venture capitalist (VC) to support you with a series of investments that will most likely start well above $1 mill.